When it comes to managing your financial and tax affairs, most people know that trusts can be a useful tool. However, the tax treatment of trusts can be very complex. Making a “family trust election” can simplify the rules. It comes at the cost of reduced flexibility and heavy penalties for breaching the election. This article explains in simple terms what is the election, how its made and the consequences.

What is a family trust?

The starting point is to understand how tax law distinguishes between different types of trust. Tax law recognises two types of trusts:

- Fixed trusts, where the beneficiary has a fixed entitlement to the capital and income (for example, a listed unit trust for property investments).

- Non-fixed trusts, also called discretionary trusts.

A family trust is a special type of discretionary trust, where the trustee makes an election to be a “family trust”.

As we’ll see, there are various reasons the trustee might wish to do this.

Why should I make a family trust election?

Over the years tax law has evolved numerous anti-avoidance measures to stop tax avoidance through trusts. Some of these laws make it very difficult for discretionary trusts to use tax losses and franking credits from dividends.

By making a family trust election, a trust is able to avoid many of the onerous anti-avoidance rules and reporting that most trusts have to undertake.

- If the trust receives income in the form of dividends, it can pass on any related franking credits to the beneficiaries.

- A very common structure is for the business in a company to be owned by a discretionary trust. If the the company makes a capital tax loss these losses can be lost, unless strict rules are followed. A family trust election makes it easier for the company to satisfy the one these rules called the “continuity of ownership” test. This allows the company to carry forward capital losses and offset them against future gains, therefore reducing capital gains tax liability.

- The trust may have previous revenue tax losses or want to write off bad debts. Again, there are strict anti-avoidance rules in place. The FTE allows the trust to pass the “pattern of distribution test” and the “control test”. This means the trust can use the losses.

- The election can allow the trust to satisfy the “income injecting” rules. These rules are intended to stop losses in a trust being soaked up by “injecting” income into the trust. For example, one trust distributing income to another trust simply to benefit from that second trust’s losses. But if the two trusts both make an election, then the distribution may be permitted – allowing the tax losses to be absorbed.

- Reporting requirements may be less onerous (the trust may avoid the trustee beneficiary reporting – or “TBR” – rules).

FTE Summary

The table below highlights key differences between rules for the different types of trust and therefore when an election might make sense.

| Type of trust | Tests required to claim tax revenue losses and bad debts | Pass on franking credits | Income injection test |

| Fixed Trust | 50% stake test | Yes | Yes |

| Non-Fixed Trust (i.e. Discretionary Trust) | Pattern of Distribution Test and Control Test | No | Yes |

| Family Trust | No test required | Yes | Yes |

How to make a family trust election

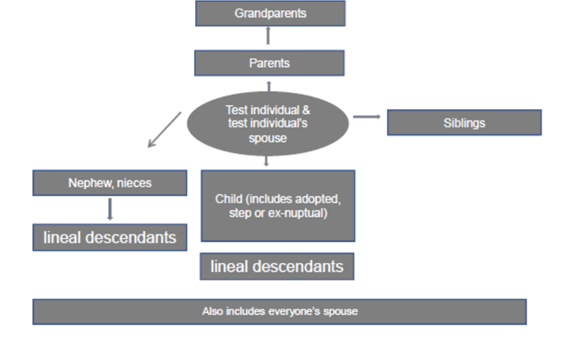

The family trust election nominates a specific person – known as the test individual. The election is made in writing, using a form published by the ATO. It’s an important choice to get right, because the decision will have significant long-term implications.

Essentially, once a FTE is made the trust can only distribute income to members of the family group, without a significant tax penalty being applied. The family group refers to the family members centered around the test individual. It includes:

- The test individual and their spouse.

- Any parent, grandparent, brother or sister of the test individual (or the test individual’s spouse).

- Any nephew, niece or child of the test individual, or their spouse, and any lineal descendent of these individuals.

- The spouse of anyone mentioned above.

Relationship between test individual and the family group

The family group can also include companies, partnerships and trusts that are wholly owned by any of the above or that have made an “Interposed Entity Election” (or “IEE”). Take, for example, a trust that has a company as the beneficiary. The company could form part of the family group if wholly owned by a family group member or has made an IEE.

The family trust must also satisfy the family control test. That’s a set of specific rules that require the trust to be controlled by family members or individuals connected to the family (such as an adviser).

Are there any traps to watch out for?

After the election the trust can only distribute to the test individual’s family group. That means only members of the “family” can receive distributions. Any distribution outside the family is subject to Family Trust Distribution Tax, charged at the top personal marginal rate (with the Medicare levy also applied) – so, currently 47%.

Family trusts can seem like an easy answer to a range of different tax problems. But be careful. They can be a complex area of tax law, especially when dealing with how the various the tests apply, or when dealing with losses or franking credits from dividends.