Starting a new business can be an exciting time, with lots to think about. One of the earliest and most important decisions you will make is what business structure to use.

Choice of business structure impacts your potential tax and legal liability and influences how clients, competitors and potential employees perceive your business.

This short guide will explain the differences and help you make the right decision.

What are the different types of business structures?

There are basically five different types of structure used for setting up a business:

- Sole trader – where you carry out the business personally, either under your own name or a trading name. It’s the simplest structure to understand and the easiest to set up.

- Company – a company is legally a separate entity from you. It has shareholders (owners) and is run by directors, who are appointed by the shareholders. For most small businesses, the directors and shareholders are the same people. A company provides you with some additional protection from liability but comes with extra administration and complexity. Companies are governed by the Corporations Act and are taxed separately.

- Partnership – consists of two or more individuals or companies who join forces to share in the profits and losses of a business enterprise. A partnership is not a separate legal entity, so each partner can be responsible for the debts of the partnership and risk is shared “jointly and severally”.

- Trust – a legal relationship, where one person (the “trustee”) holds the business assets “on trust” and manages the business for the benefit of others (the “beneficiaries”). This is the most complex form of business structure, but can provide additional benefits.

- Joint venture – an arrangement where two or more parties pool their resources and work together towards a specific outcome. Unlike a partnership (which is usually used for an ongoing business), a joint venture is often used just for a single project or as a temporary arrangement. This type of structure is uncommon for small businesses.

Only the first four are taken into account for tax purposes because tax law doesn’t recognise the concept of a joint venture.

Remember too that you can combine different legal structures to achieve your business and financial objectives. For example, you might decide to establish a company to run your business, but with the company owned by a trust. Another option might be to have a partnership of companies, where each partner is itself a company.

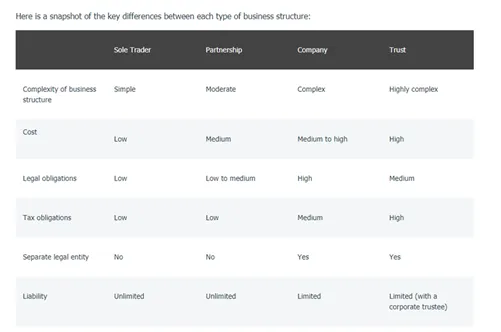

What are the key differences between each business structure?

Each business structure has its own unique advantages and disadvantages.

Sole trader

Running your business as a sole trader is the easiest structure to set up and the least expensive too. The business is set up under your own name (although you might have a separate business or trading name too). You will also enter into any contracts, debts, business commitments, and so on, in your own name. You can also hire employees, open separate bank accounts and do all those other things a company would do. This makes you personally liable for any commitments of the business, which could put your personal assets at risk. For example, if you get into a dispute with a customer or supplier and they decide to sue you.

As a sole trader, you have far fewer reporting requirements than under other business structures, which helps reduce compliance costs. However, you still need to lodge a personal tax return and you’ll be liable for the tax on the business profits. You will also need to lodge a Business Activity Statement if you are registered for GST.

Company

When you establish a company, you are creating a separate legal entity. A company has shareholders, who are the owners and directors, who are legally responsible for the company. In most small businesses these are the same. The company can enter contracts, incur debts or other liabilities and sue other people or companies, or be sued itself.

This is all separate to your own personal liability. As the owner and shareholder of a company, your own liability is effectively limited to the value of your shareholding (although you can incur personal liability as the director of a company in some situations). This limited liability is one of the main benefits of operating under a company structure.

The trade-off is that it takes some time and cost to set up a company and to manage its annual compliance requirements. The company will need to comply with the Corporations Act, keep proper financial records and lodge a separate company tax return with the ATO.

As the shareholder of the company, you get the profits of the business by way of dividends. In the Australian tax system, there are advantages to dividends because you also get any attached franking credits. This means the income you receive already has tax paid on it, saving you money.

Companies are an extremely common business structure and may give your business more credibility with suppliers, customers, employees and investors.

Partnership

Under a partnership, two or more people agree to work together to run a business and to share the profits (or losses) between themselves. The partners will often enter into a Partnership Agreement, setting out how the partnership will be managed. Depending on the type of partnership, each partner can have unlimited liability for the debts of the partnership (a “general partnership”) or have liability up to a limit based on how much they have contributed (a “limited partnership”). It’s also possible to have an Incorporated Limited Partnership (ILP), although this needs to have one general partner who has unlimited liability.

A partnership is not a separate legal entity (in the way that a company is) but is treated separately from its partners for tax purposes, which means the partnership must apply for its own TFN and lodge a partnership tax return. However, the partnership doesn’t pay income tax – instead, each individual partner pays the tax on their share of the net partnership income.

Trust

Under a trust arrangement, the trustee holds and manages the business assets on behalf of the beneficiaries. Often the trustee will itself be a company, which helps the owner limit their liability and protect their personal assets from any potential claim.

To form a trust, you will need a Trust Deed that sets out how the trust will operate. Establishing the trust and complying with the annual compliance requirements usually makes a trust the most complex and expensive of the different business structures available. However, the benefit for business owners of a trust arrangement is that it can provide a lot more flexibility for tax purposes and personal financial planning. As with a partnership, the trust will also have its own TFN and is required to lodge an annual income tax return.

Joint venture

A joint venture involves two or more businesses working together towards a shared goal. Each business remains separate, and maintains its own independence, but agrees to work with the other business (or businesses) towards a combined project or objective. In that sense, it’s like a partnership but it is not usually an ongoing arrangement and the parties will end the joint venture when its objectives have been achieved. The parties will usually have signed up to a Joint Venture Agreement that sets out their obligations and details of how the joint venture will be managed. That will also set out how they are going to share the profits of the joint venture.

The tax system does not recognise joint ventures, so each party in the joint venture will normally be required to lodge its own tax return. However, the tax implications of a joint venture can quickly become complicated, and it is always best to obtain specialist advice as to how being part of a joint venture will affect your own situation.

Which structure is best for my business?

The choice of structure will depend on your aims for the business. If you start small and intend to remain a side-hussle, then a sole trader is the best way to go. If you want to raise capital, you need a company. Want to enter into business with other people? Then a trust or partnership would be a good option to consider.

The table below provides a helpful summary of the key differences between the different types of structure:

What are the registration requirements for my business structure?

When setting up your business, the choice of business structure will determine the various applications and registrations you will have to make and obtain – such as getting an ABN or TFN, registering for GST or other taxes, and registering with ASIC.

For a quick guide to help you with the terminology and to work out what business registrations you will need, please see our previous article: Registering your business.