Small businesses can grow in prosperous times as well as periods of difficulty – which we’ve seen some incredible examples of that in 2020 alone! We believe that 2021 will be a period of expansion, so it’s timely that we share these tips with you for your business growth and success.

Use technology

Technology can save you lots of time, help with organisation and even save you money. Facebook, Linkedin and Instagram are powerful marketing tools for your business. If you’re not sure where to begin, there are lots of online tutorials and freelancers who can help get your business into the social sphere.

Dropbox is an affordable and effective cloud-based option for storing your files – and especially useful for teams during remote working situations. Of course, we’re all getting used to Zoom for video calling, there are also options like Google Meet – saving travel time and keeping national and international businesses connected.

Communicate better

Use a friendly and professional approach to communicate with your customers and communicate often to promote a strong relationship. Create guidelines for for your team so that dealing with customers in writing and over the phone in consistent across the company.

Be punctual in your replies and slow down and read their emails carefully. In our rush to be efficient, sometimes we’re the opposite.

Write blogs relevant to your industry helps to share information and elevate your business as an authority on the topic.

Innovate

Hold regular brainstorming sessions with the entire team, when possible, to share ideas and ways to improve what you offer. Even if your products or services are selling well, it’s good to have new ideas in the pipeline and make incremental improvements.

Get strict with your credit policies

Make sure your customers have a completed credit application on file and that they’ve read and understood the terms and conditions.

Make your payment process really clear and ensure that you’re sending out invoices in a timely fashion, so they can be paid on time.

Review and update your terms and conditions to keep them current and working in your favour.

Improve your record keeping

For product based businesses, keeping track of inventory is essential for the smooth running of your business. There are free and inexpensive point of sales systems that can help you manage stock and keep your records tidy.

Capture customer details to stay in communication with them for future sales too.

Join business associations and organisations

Business associations and organisations give you access to industry leaders and an opportunity to network. They usually have an annual membership fee, which is a worthwhile investment as they hold regular events, seminars, short courses and networking evenings.

This can be invaluable for meeting business owners, learning more about your industry and being recognised as a leader in your sector.

Update your website

If you’ve been neglecting your website, now’s the time to give it a tidy up. Your customers want to see that you’ve got a well-established business and will look up your website before they phone or make an appointment. It’s important that the information is clear, easy to find and up to date.

Block your time

You could be wasting hours every day, so take note of where your time is going and find ways to improve your productivity. Often we’re swapping between a variety of tasks, and each time we do that we lose valuable time. Blocking your time to focus on one task at a time will see you complete more things every day. Programs like Toggl track your time per task, so you can monitor what you’re spending the most time on – and whether that matches with what brings you the most business. It can also help you stay on track just for the mere fact that you know you’re being timed!

Network better

It’s easy to fall into the trap of trying to meet as many people as possible, and whilst this can create some loose ties, really honing in on who you need to meet and spending time on growing those relationships will serve you much better in the long-term.

Create referrals

There are many ways to attain referrals and grow your business. Some ways are: asking your previous clients for recommendations, offering an affiliate referral incentive, write a guest blog or traditional advertising channels.

Choose a mix of methods for your small business to keep moving things positively, take some time to plan ahead and try some new approaches.

All the best, we wish you well in business. If you want some support, call us.

Boosting your profits in 2021: a simple strategy to control costs

Running your own business is exciting and challenging and that’s before you start thinking about making a profit. But creeping costs can hinder your business from making a decent return for all the effort you put in. Set out below is a simple way to control costs and boost profits.

Often the suggested remedy is a budget and financial forecast. But these take significant time and knowledge to prepare – and for many small businesses, will not be a good tool to manage costs. After all, who is going to notice if you spend more than you budget? For small businesses formal budgets and forecasts are usually more trouble than they’re worth. This is especially the case if your business is growing rapidly, because any budget you create will soon be out of date.

But, there is a simple way to monitor costs and to make sure they don’t get out of control.

A simple calculation to control costs

The simple way to keep costs under control is to perform a calculation (for anyone who hate spreadsheets, relax, this will be painless), using the finance data you already collect. Just follow these simple couple of steps.

Firstly, make sure your books are up to date. If your accountant or bookkeeper does the numbers monthly, use that. If quarterly, then use the last quarters numbers.

Next look at your profit and loss statement and work out how much revenue you produced last period and what are your total expenses (ignore tax if its included). Deduct the expenses from the revenue to give you net profit. It might already be at the bottom of the report (if not, get your accountant or bookkeeper to fix it).

Then, divide the net profit by total revenue to get a percentage. This is called (to use the technical term) the net profit margin.

Here is an example

Let’s say you generate $10,000 in revenue in December and costs were $8,000, so profit is $2,000. Therefore, your net profit margin is 20% ($2,000 / $10,000). It means that for every $1 in revenue, your business made 20c in profit.

Calculate the net profit percentage each month for the past year (or however long you have data for) and put the results in a graph.

Controling costs

Now that you’re set up, its easy to use net profit ratio to manage your costs. At the end of each period do the calculation. If the percentage is falling, then it means you are making less profit for every $1 of revenue you generate. If the ratio is falling month after month, then you probably need to have a little look at where your spending is going.

Let’s see how Kath and Meg managed their costs

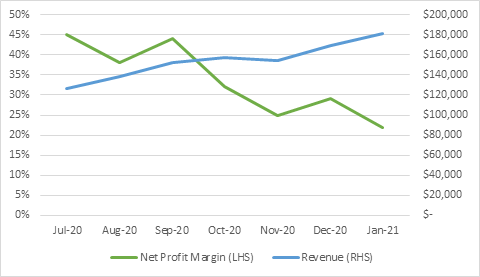

Kath and Meg run a fast-growing new media company that focusses on the home décor market. Revenue has been growing at around 10% per month for the past year, but the owners keep finding they have less cash at the end of each month. They’re followed the steps above and have graphed their net profit ratio.

While revenue is growing fast, costs are increasing much faster.

What can be done?

The solution depends on the reason that costs are rising faster than revenue. The owners may have made a strategic decision to invest in the business – as making important hires and spending on marketing to build the brand will pay off later, with higher revenue and bigger profits. If that’s the case, then having the net profit margin going down for a while is fine.

However, if rising costs are not a conscious decision (maybe the spending on champagne and caviar has crept up too high?) then it’s time to have a hard-headed look at where costs are going. Increasing costs are hard to suddenly turn around and reduce, so the first goal should be to ensure that they at least stop rising. In January, the net profit margin was 22%, so Kath and Meg’s goal for February should be to maintain it at no more than 22%. If revenue keeps rising, as it has in the past, they will see an improvement in profitability, no matter what else happens.

Then, next month, raising the target a little bit – perhaps try 24% or 25%. Nothing too big. Taking small steps is easier than one giant leap. Over time they will get back to 45%.

So, how do I actually reduce costs?

This is the tricky bit.

I usually suggest sitting down at the start of the month to review the prior month’s expenses. This should be easily obtainable from your bookkeeper or accountant. If you don’t know how to get the data from your accounting system yourself, ask them how to do it.

Kath and Meg sat down last Sunday with a bottle of Rose and ran down the list of expenses categorizing them into “must spend” and “nice to haves”. It was brutal, but they kept each other honest. A “must spend” is something that if you don’t spend it, the business stops working. Think of examples, like office rent, software systems, salaries. Everything else is a nice to have.

They decided they could do without the fresh flowers in the office every week and the weekly team long Friday lunches were downgraded to monthly Friday night drinks at the bar round the corner. They also found a number of automatic subscriptions they never used on their credit cards – these were quickly cancelled.

Over time the “must spend” become easier to reduce as well. Did they really need as much office space? Perhaps Kath and Meg improve processes and free up staff capacity, so they didn’t have to hire more staff.

Every business has to keep costs under control, otherwise they quickly go out of business!

The net profit margin is simple to calculate and tells you quickly whether costs are increasing. If they are, start by having a good hard look at the “nice to haves” before over time moving onto the “must spend”.

Increasing profits

Keeping costs under control is one element of increasing costs. The other is increasing revenue. The first step is acquising customers and making sure that the cost to acquire each customer is lower than the revenue they generate.

You also need to ensure your selling price is high enough to cover costs. Calculating your breakeven point lets you know how much revenue you need to generate in order to be profitable.

How much should you charge for your products or services? There are many factors to consider, from competitor pricing, target market and your cost to deliver. Your break-even point is the minimum amount you have to charge for your product or service in order to cover your costs. Or to put it another way, calculate your break even point to work out how many you need to sell to make a profit. Sell for less than the breakeven amount and you make a loss. Sell for more, make a profit.

When sales equal costs

Your business will incur costs in order to operate. You have fixed costs (business overheads) that you must pay each month to keep your operation running.

You also have other expenses that will vary with sales levels. These variable costs include supplies to make a product or to stock shelves (if you sell more, you’ll need more), freight, commissions, and extra labour to produce your goods.

All of this means that a typical business in its early stages will run at a loss until the point where revenue from sales equals costs. This is known as the break-even point.

As sales continue to increase faster than your expenses increase, you generate a profit. Your profit is your reward for taking a risk and starting a business.

Below are two quick and ready ways to test the feasibility of your business. They presume you know both the fixed costs of running your business and the variable costs of producing a product or selling a service.

How manufacturing businesses calculate breaks-even point

A manufacturing business calculates a break-even point by taking into consideration not only their overheads, but also the cost to manufacture their goods. Here’s an example for a business making garden benches out of wood.

First, work out the gross profit on each bench. This is the difference between the selling price of the product and its variable production costs. That is, how much it costs you to produce each bench.

The cost of each bench

| Your research shows a realistic market price for each bench is: | $120 |

| Labour cost ($40) and materials ($25) for each chair come to: | $65 |

| The difference between $120 and $65 is your gross profit: | $55 |

What you want from your business

| To justify the risk, you want a salary each year of: | $80,000 |

| The overhead costs of running your business are: | $20,000 |

| Therefore, the annual gross profit you need on sales is: | $100,000 |

How many sales do you need?

To find out how many benches you must sell each year to meet your salary goal, divide the required $100,000 gross profit by the gross profit per bench of $55. The result shows you need to sell 1,818 benches a year.

How does that average out per week? If you decide you want at least a four-week break every year, divide 1,818 by 48 weeks and your break-even sales target is 38 benches a week.

Do you think you can sell an average of 38 benches a week? Remember, this is a break-even point only. It will pay your required salary, but there’s no extra profit margin in there to grow your business.

Try your own figures.

How a service business calculate breaks-even point

In a service business, you’re selling time, so you take a slightly different approach. Let’s presume the goals remain similar and you’re working alone, except for one part-time person doing office tasks so you can spend more time with customers. This salary adds $20,000 to your overheads.

What you want from your business

To justify the risk, you want a salary each year of: $80,000

| The overhead costs of running your business are: | $40,000 |

| Therefore, you’ll need to bill out: | $120,000 |

What time do you have available?

You decide to work 5 days a week, for 48 weeks, or 240 days a year. Subtract another 15 days for sickness and holidays, leaving a total of 225 working days.

You plan to put in at least 8 hours a day but allow 3 hours for travelling and work such as marketing and quotations. This leaves 5 billable hours a day.

Your hourly charge-out rate

Now you’re ready to calculate your charge-out rate.

Billable hours per year = 5 hours per day x 225 working days – or 1,125 billable hours.

Divide your goal of $120,000 by 1,125 billable hours and your minimum charge-out rate per hour must be $107. Remember this is just the break-even figure to cover your costs and salary. There’s no extra profit to expand the business.

Some questions to ask include:

-

- How does an hourly rate of $107 compare with the industry average? Is it competitive?

- Can you really bill out $535 a day (107 x 5 billable hours), or $2,675 each 5-day working week?

Try your own figures to see what hourly rate you come up with and decide if the rate is both competitive and feasible. Will you be able to meet that goal of 25 billable hours each week?

Use a cash flow forecast

Use a cash flow forecast to check your break-even calculations. This will force you to think more carefully about both variable costs and fixed costs. Get advice if necessary from an accountant because a portion of some costs, such as extra power use, may properly belong in variable costs of production rather than fixed costs.

Completing the sales side of your cash flow forecast will also help you identify how long it might take for your venture to break even.

For example, in the manufacturing example, the business needs to sell 1,818 garden benches over the course of the year. However, demand would likely be slow in the winter months before picking up in the spring. Meanwhile, the business’s running costs still need to be paid.

The bottom-line figure for each month will show you both when your business is likely to break even and how much funding you’ll need to keep your business going until then.

Wrap Up

When you combine break even analysis, with other analytical tools such as customer lifetime value analysis, you end up with a very comprehensive view of what your business can do. Will it make you enough to justify the risk or do you have to tweak something in the business model to make it perform at its best?

JD Scott + Co is one of Sydney’s leading Chartered Accounting firms, we aim to help build your business and wealth, empowering you to reach your goals.