Boosting your profits in 2021: a simple strategy to control costs

Running your own business is exciting and challenging and that’s before you start thinking about making a profit. But creeping costs can hinder your business from making a decent return for all the effort you put in. Set out below is a simple way to control costs and boost profits.

Often the suggested remedy is a budget and financial forecast. But these take significant time and knowledge to prepare – and for many small businesses, will not be a good tool to manage costs. After all, who is going to notice if you spend more than you budget? For small businesses formal budgets and forecasts are usually more trouble than they’re worth. This is especially the case if your business is growing rapidly, because any budget you create will soon be out of date.

But, there is a simple way to monitor costs and to make sure they don’t get out of control.

A simple calculation to control costs

The simple way to keep costs under control is to perform a calculation (for anyone who hate spreadsheets, relax, this will be painless), using the finance data you already collect. Just follow these simple couple of steps.

Firstly, make sure your books are up to date. If your accountant or bookkeeper does the numbers monthly, use that. If quarterly, then use the last quarters numbers.

Next look at your profit and loss statement and work out how much revenue you produced last period and what are your total expenses (ignore tax if its included). Deduct the expenses from the revenue to give you net profit. It might already be at the bottom of the report (if not, get your accountant or bookkeeper to fix it).

Then, divide the net profit by total revenue to get a percentage. This is called (to use the technical term) the net profit margin.

Here is an example

Let’s say you generate $10,000 in revenue in December and costs were $8,000, so profit is $2,000. Therefore, your net profit margin is 20% ($2,000 / $10,000). It means that for every $1 in revenue, your business made 20c in profit.

Calculate the net profit percentage each month for the past year (or however long you have data for) and put the results in a graph.

Controling costs

Now that you’re set up, its easy to use net profit ratio to manage your costs. At the end of each period do the calculation. If the percentage is falling, then it means you are making less profit for every $1 of revenue you generate. If the ratio is falling month after month, then you probably need to have a little look at where your spending is going.

Let’s see how Kath and Meg managed their costs

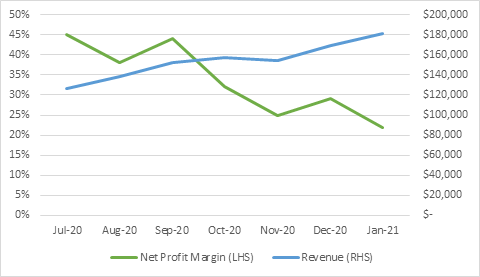

Kath and Meg run a fast-growing new media company that focusses on the home décor market. Revenue has been growing at around 10% per month for the past year, but the owners keep finding they have less cash at the end of each month. They’re followed the steps above and have graphed their net profit ratio.

While revenue is growing fast, costs are increasing much faster.

What can be done?

The solution depends on the reason that costs are rising faster than revenue. The owners may have made a strategic decision to invest in the business – as making important hires and spending on marketing to build the brand will pay off later, with higher revenue and bigger profits. If that’s the case, then having the net profit margin going down for a while is fine.

However, if rising costs are not a conscious decision (maybe the spending on champagne and caviar has crept up too high?) then it’s time to have a hard-headed look at where costs are going. Increasing costs are hard to suddenly turn around and reduce, so the first goal should be to ensure that they at least stop rising. In January, the net profit margin was 22%, so Kath and Meg’s goal for February should be to maintain it at no more than 22%. If revenue keeps rising, as it has in the past, they will see an improvement in profitability, no matter what else happens.

Then, next month, raising the target a little bit – perhaps try 24% or 25%. Nothing too big. Taking small steps is easier than one giant leap. Over time they will get back to 45%.

So, how do I actually reduce costs?

This is the tricky bit.

I usually suggest sitting down at the start of the month to review the prior month’s expenses. This should be easily obtainable from your bookkeeper or accountant. If you don’t know how to get the data from your accounting system yourself, ask them how to do it.

Kath and Meg sat down last Sunday with a bottle of Rose and ran down the list of expenses categorizing them into “must spend” and “nice to haves”. It was brutal, but they kept each other honest. A “must spend” is something that if you don’t spend it, the business stops working. Think of examples, like office rent, software systems, salaries. Everything else is a nice to have.

They decided they could do without the fresh flowers in the office every week and the weekly team long Friday lunches were downgraded to monthly Friday night drinks at the bar round the corner. They also found a number of automatic subscriptions they never used on their credit cards – these were quickly cancelled.

Over time the “must spend” become easier to reduce as well. Did they really need as much office space? Perhaps Kath and Meg improve processes and free up staff capacity, so they didn’t have to hire more staff.

Every business has to keep costs under control, otherwise they quickly go out of business!

The net profit margin is simple to calculate and tells you quickly whether costs are increasing. If they are, start by having a good hard look at the “nice to haves” before over time moving onto the “must spend”.

Increasing profits

Keeping costs under control is one element of increasing costs. The other is increasing revenue. The first step is acquising customers and making sure that the cost to acquire each customer is lower than the revenue they generate.

You also need to ensure your selling price is high enough to cover costs. Calculating your breakeven point lets you know how much revenue you need to generate in order to be profitable.